Ichimoku Trading Series: Part 8 of 10 | ← Previous | View Full Series

The backtesting.py Framework

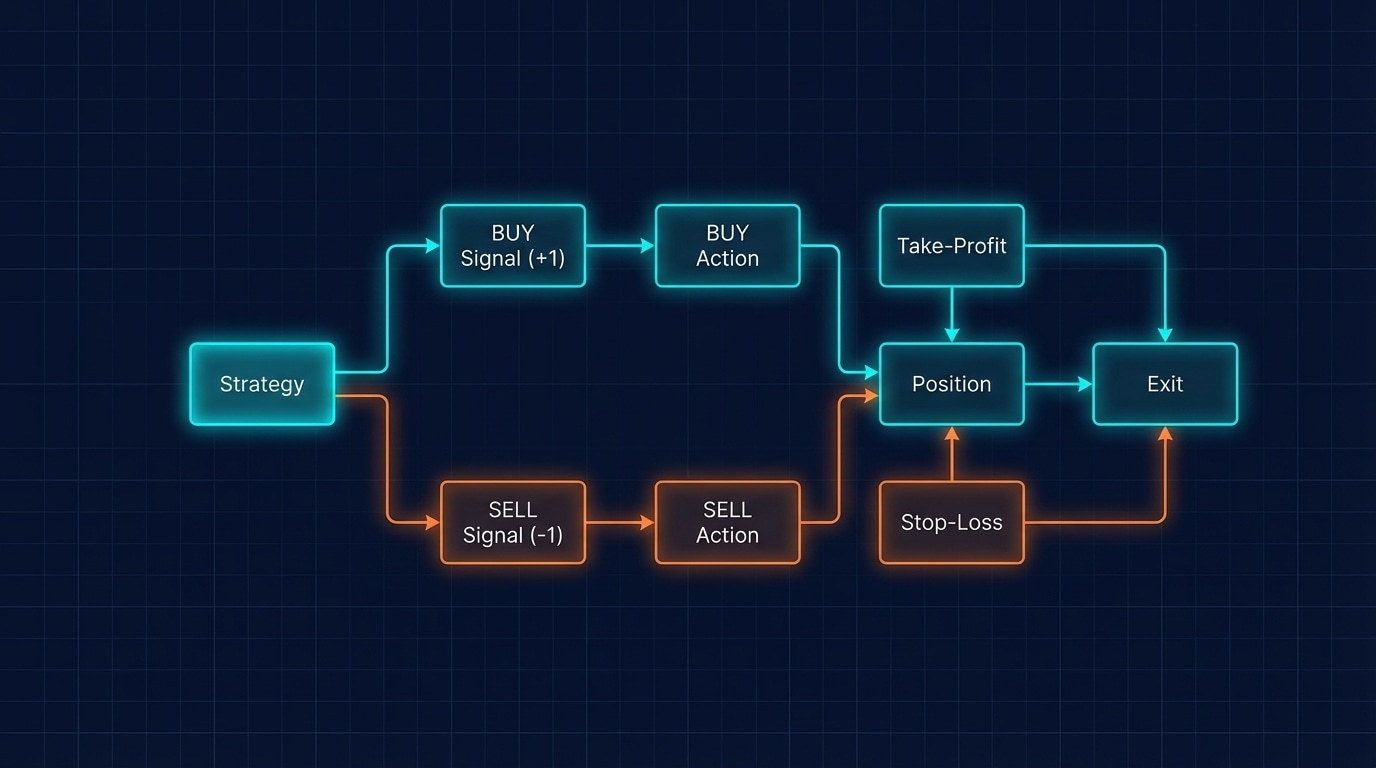

The backtesting library uses a class-based approach where:

init()runs once at the startnext()runs on every candle

Complete Strategy Class

from backtesting import Strategy

class SignalStrategy(Strategy):

"""

Ichimoku + EMA trend-following strategy.

Entry: Pre-computed signal column (+1 long, -1 short)

Exit: ATR-based SL and RR-based TP

"""

# Class-level parameters (can be optimized)

atr_mult_sl: float = 1.5 # SL distance = ATR x this

rr_mult_tp: float = 2.0 # TP distance = SL x this

def init(self):

"""Initialize indicators (we pre-compute, so nothing needed here)."""

pass

def next(self):

"""Called on every bar. Check for signals and manage positions."""

i = -1 # Current bar

signal = int(self.data.signal[i]) # +1 long, -1 short, 0 none

close = float(self.data.Close[i])

atr = float(self.data.ATR[i])

# Safety check

if not (atr > 0):

return

# --- Manage open trades ---

if self.position:

# Let SL/TP handle exits automatically

return

# --- New entry logic ---

sl_dist = atr * self.atr_mult_sl

tp_dist = sl_dist * self.rr_mult_tp

if signal == 1: # LONG entry

sl = close - sl_dist

tp = close + tp_dist

self.buy(size=0.99, sl=sl, tp=tp)

elif signal == -1: # SHORT entry

sl = close + sl_dist

tp = close - tp_dist

self.sell(size=0.99, sl=sl, tp=tp)Key Design Decisions

1. Pre-Computed Signals

We calculate signals BEFORE backtesting (in pandas), then the strategy just reads them. This is cleaner and faster.

2. Position Check

if self.position:

returnWe do not stack trades — one position at a time.

3. Size = 0.99

self.buy(size=0.99, sl=sl, tp=tp)Using 99% of available equity leaves room for rounding.

Running the Backtest

def run_backtest(symbol, start, end, interval, cash, commission, show_plot=True):

# Prepare data

df = fetch_data(symbol, start, end, interval)

df = add_ichimoku(df)

df["EMA"] = ta.ema(df.Close, length=100)

df = MovingAverageSignal(df, back_candles=7)

df = createSignals(df, lookback_window=10, min_confirm=7)

df = df.dropna()

# Create backtest

bt = Backtest(

df,

SignalStrategy,

cash=cash,

commission=commission,

trade_on_close=True,

exclusive_orders=True,

margin=1/10, # 10x leverage

)

# Run and display results

stats = bt.run()

print(f"\n=== {symbol} Signal Strategy ===")

print(stats)

if show_plot:

bt.plot(open_browser=False)

return stats, df, bt

# Execute

stats, df, bt = run_backtest(

symbol="USDCHF=X",

start="2023-10-01",

end="2024-10-01",

interval="4h",

cash=1_000_000,

commission=0.0002

)Example Output

=== USDCHF=X Signal Strategy ===

Return [%] 28.5

Sharpe Ratio 1.02

Max. Drawdown [%] -6.3

Avg. Drawdown [%] -3.7

Win Rate [%] 53.8

# Trades 13

Exposure Time [%] 42.1