Ichimoku Trading Series: Part 6 of 10 | ← Previous | View Full Series

ATR-Based Risk Management

Instead of fixed pip distances, we use the Average True Range (ATR) to adapt our stops to current market volatility.

Why ATR?

- In volatile markets → wider stops (avoid noise)

- In calm markets → tighter stops (maximize R:R)

- Automatically adapts to the instrument

The Formulas

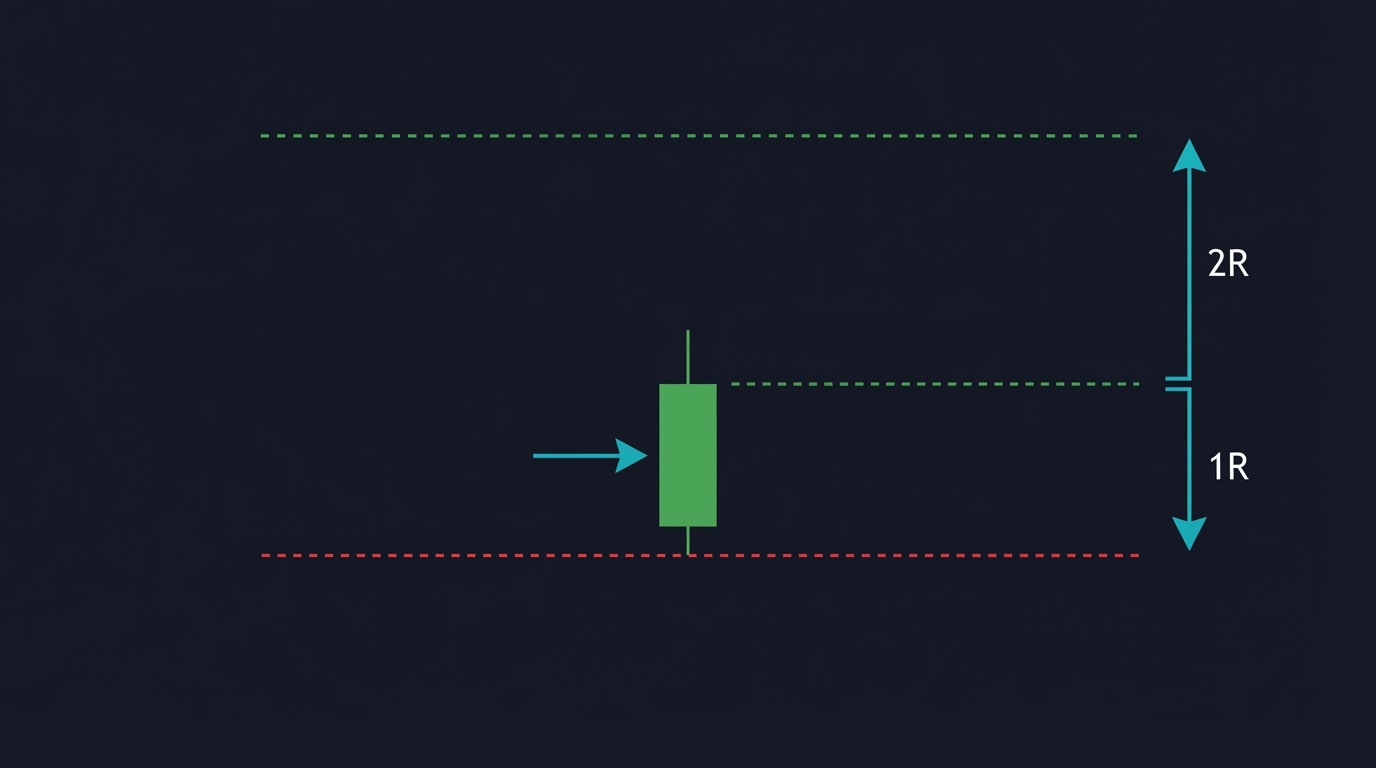

Stop-Loss Distance

SL_distance = ATR × ATR_MULT_SL

# For long: SL = entry - SL_distance

# For short: SL = entry + SL_distanceTake-Profit Distance

TP_distance = SL_distance × RR_MULT_TP

# For long: TP = entry + TP_distance

# For short: TP = entry - TP_distanceDefault Parameters

ATR_LEN = 14 # ATR lookback period

ATR_MULT_SL = 2.0 # SL = ATR × 2

ATR_MULT_TP = 4.0 # TP = ATR × 4 (gives 2R)With these defaults:

- Risk-Reward Ratio = 4 / 2 = 2R

- Win only 33% of the time to break even

- Our 53-69% win rate means consistent profits

Optimization Insights

From backtesting results:

| ATR Multiplier | Best RR Ratio | Returns |

|---|---|---|

| 1.0 (tight) | 2.5-2.9 | Highest |

| 1.5 (medium) | 1.5-2.0 | Good |

| 2.0 (wide) | 1.0-1.5 | Moderate |

Key Finding: Tight stops with high R:R work best!

“The best set of parameters is decreasing like this. Either you have a high stop-loss distance and a low risk-reward ratio, or you have a low ATR multiplier or stop-loss distance and a high risk-reward ratio — which actually is working the best for this strategy.”

Why Tight Stops Work Here

Because we are entering at cloud bounces (retracements):

“We are squeezing our entry position to the retracement to the minimum of the retracement when we are dipping within inside of the cloud and just getting out of it. So this is why you do not need a very wide stop-loss distance.”

Code Implementation

# Risk settings

ATR_LEN = 14

ATR_MULT_SL = 1.5 # Tight stop-loss

ATR_MULT_TP = 3.0 # Higher R:R (2R)

# In strategy:

sl_dist = atr * self.atr_mult_sl

tp_dist = sl_dist * self.rr_mult_tp

if signal == 1: # Long entry

sl = close - sl_dist

tp = close + tp_dist

self.buy(size=0.99, sl=sl, tp=tp)

elif signal == -1: # Short entry

sl = close + sl_dist

tp = close - tp_dist

self.sell(size=0.99, sl=sl, tp=tp)