Ichimoku Trading Series: Part 5 of 10 | ← Previous | View Full Series

The Perfect Entry Setup

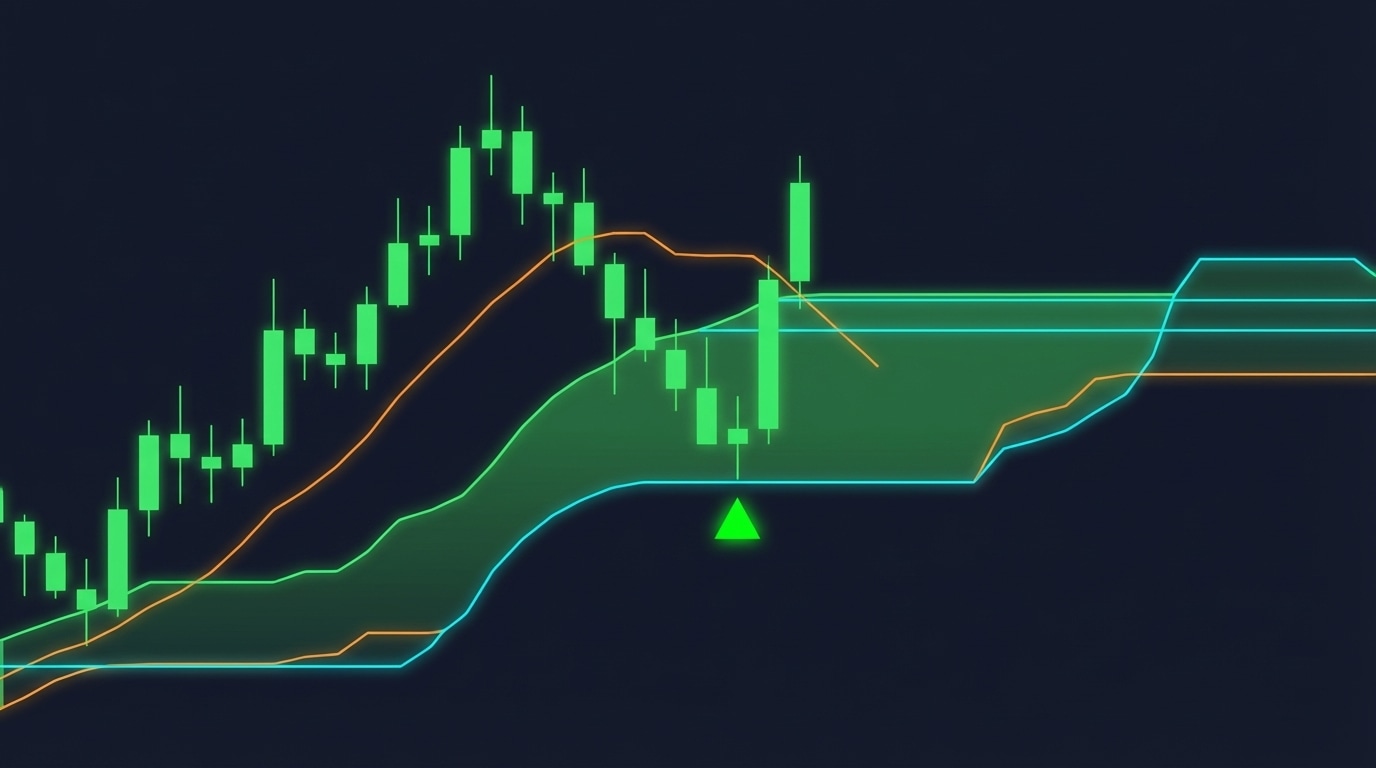

We now combine the EMA trend filter with Ichimoku cloud conditions to find high-probability entries.

Entry Rules for LONG Position

Step 1: Confirm Uptrend (EMA Filter)

EMA_signal == +1 (at least 7 candles fully above EMA 100)Step 2: Confirm Momentum (Ichimoku Cloud)

Within the last 10 candles, at least 7 must be FULLY ABOVE the cloud“Fully above” means: Open > cloud_top AND Close > cloud_top

Step 3: The Entry Trigger (Cloud Pierce)

Current candle opens INSIDE the cloud AND closes ABOVE itThis represents a retracement that is bouncing back into the trend direction.

Entry Rules for SHORT Position

Mirror image:

EMA_signal == -1- At least 7 of 10 candles fully BELOW cloud

- Current candle opens inside cloud, closes BELOW

Why These Rules Work

“We are trading with a trend and we are trying to capture patterns where candles are also above the Ichimoku cloud confirming a strong momentum. But then we look for a candle dipping or bouncing in and out of the cloud because we are looking for some kind of a retracement.”

The key insight:

“When the candle closes above the cloud, we assume that the retracement is over and the price will probably continue in the direction of the main trend.”

Code Implementation

def createSignals(df: pd.DataFrame,

lookback_window: int = 10,

min_confirm: int = 5,

ema_signal_col: str = "EMA_signal") -> pd.DataFrame:

"""

Produce a single signal column aligned with EMA trend:

+1 (long): Ichimoku pierce-up + enough prior bars entirely ABOVE cloud

AND EMA_signal == +1

-1 (short): Ichimoku pierce-down + enough prior bars entirely BELOW cloud

AND EMA_signal == -1

0 (none): otherwise

"""

out = df.copy()

# Cloud boundaries

cloud_top = out[["ich_spanA", "ich_spanB"]].max(axis=1)

cloud_bot = out[["ich_spanA", "ich_spanB"]].min(axis=1)

# Candles entirely above/below cloud

above_cloud = (out["Open"] > cloud_top) & (out["Close"] > cloud_top)

below_cloud = (out["Open"] < cloud_bot) & (out["Close"] < cloud_bot)

above_count = above_cloud.rolling(lookback_window, min_periods=lookback_window).sum()

below_count = below_cloud.rolling(lookback_window, min_periods=lookback_window).sum()

# Current-bar pierce conditions

pierce_up = (out["Open"] < cloud_top) & (out["Close"] > cloud_top)

pierce_down = (out["Open"] > cloud_bot) & (out["Close"] < cloud_bot)

# Trend confirmations

up_trend_ok = above_count >= min_confirm

down_trend_ok = below_count >= min_confirm

# EMA alignment

ema_up = (out[ema_signal_col] == 1)

ema_down = (out[ema_signal_col] == -1)

# Final conditions

long_cond = up_trend_ok & pierce_up & ema_up

short_cond = down_trend_ok & pierce_down & ema_down

signal = np.where(long_cond & ~short_cond, 1,

np.where(short_cond & ~long_cond, -1, 0)).astype(int)

out["signal"] = signal

return out

# Usage

df = createSignals(df, lookback_window=10, min_confirm=7)Ideal vs Non-Ideal Entries

Ideal Entry

- Small candle that dips into cloud

- Closes just above cloud top

- Three long wicks showing rejection of cloud (support)

- Tight entry close to cloud = better risk/reward

Less Ideal Entry

- Long candle that dips into cloud

- Closes far above cloud top

- Entry is “late” = wider stop-loss needed