Ichimoku Trading Series: Part 9 of 10 | ← Previous | View Full Series

The Optimization Challenge

We have two key parameters to tune:

- ATR Multiplier (stop-loss distance)

- Risk-Reward Multiplier (take-profit distance)

Grid Search Approach

# Parameter ranges

atr_range = np.arange(1.0, 2.5, 0.1) # 1.0 to 2.4

rr_range = np.arange(1.0, 3.0, 0.1) # 1.0 to 2.9

# Run optimization

stats, heatmap = bt.optimize(

atr_mult_sl=atr_range,

rr_mult_tp=rr_range,

maximize="Return [%]",

constraint=lambda param: param.rr_mult_tp >= 1,

return_heatmap=True

)Multi-Asset Testing

Test across multiple instruments to ensure robustness:

SYMBOLS = [

"EURUSD=X", "USDJPY=X", "GBPUSD=X",

"AUDUSD=X", "USDCHF=X", "USDCAD=X", "NZDUSD=X"

]

def run_all_assets(symbols, start, end, interval, cash, commission):

rows = []

for sym in symbols:

try:

stats, _, _ = run_backtest(

symbol=sym, start=start, end=end,

interval=interval, cash=cash, commission=commission,

show_plot=False

)

rows.append({

"Symbol": sym,

"Return [%]": stats.get("Return [%]"),

"MaxDD [%]": stats.get("Max. Drawdown [%]"),

"Win Rate [%]": stats.get("Win Rate [%]"),

"Trades": stats.get("# Trades"),

})

except Exception as e:

print(f"Warning {sym}: {e}")

return pd.DataFrame(rows)

summary = run_all_assets(SYMBOLS, START, END, INTERVAL, CASH, COMMISSION)

print(summary)Understanding the Heat Map

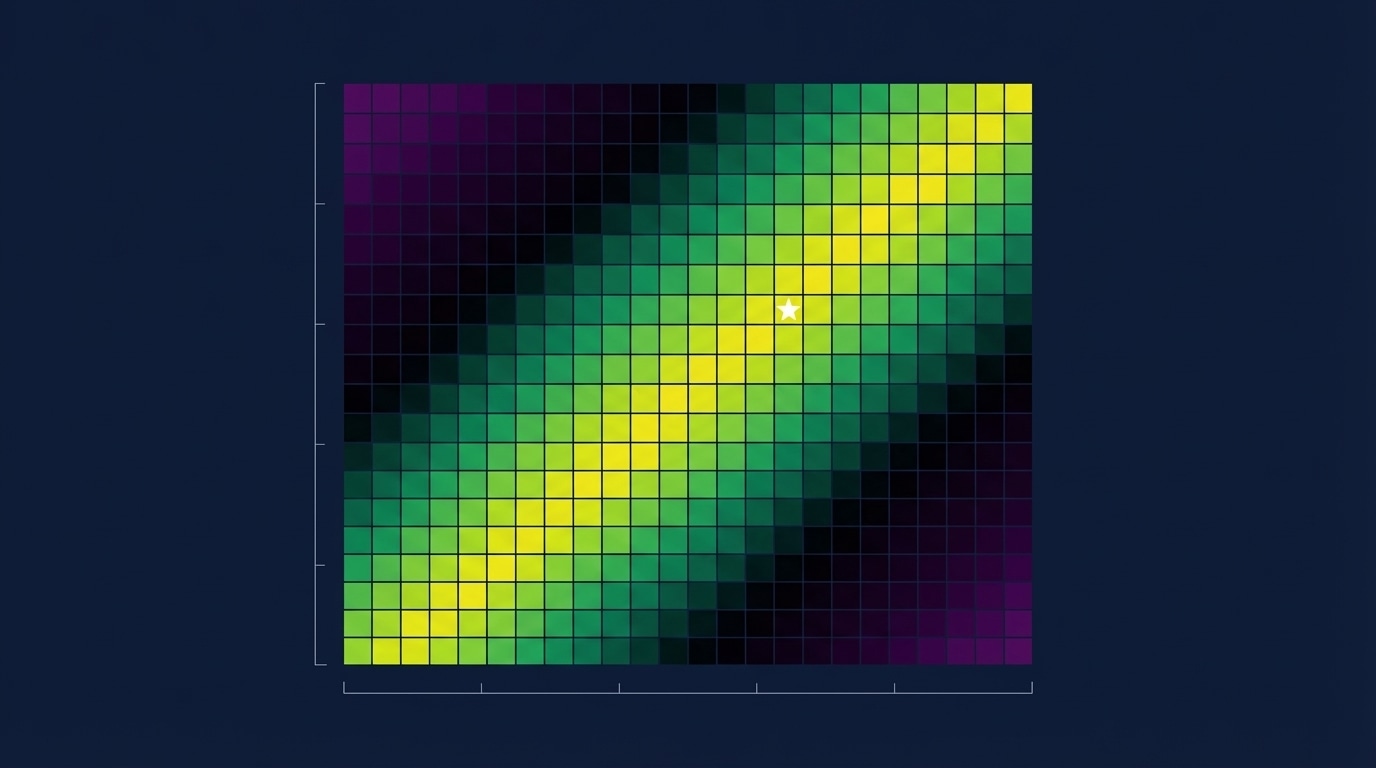

The optimization produces a heat map showing returns for each parameter combination.

Key Pattern: The Diagonal

“Notice those ridges, those clusters of returns… It is showing this decreasing slope. And this is totally normal.”

Why the diagonal?

- High ATR multiplier = wider stop-loss → needs lower R:R

- Low ATR multiplier = tighter stop-loss → can use higher R:R

“Either you have a high stop-loss distance and a low risk-reward ratio, OR you have a low ATR multiplier and a high risk-reward ratio — which actually is working the best for this strategy.”

Optimal Zone

| ATR Mult | RR Mult | Expected Return |

|---|---|---|

| 1.0-1.3 | 2.5-2.9 | 35-43% |

| 1.4-1.7 | 1.8-2.2 | 25-35% |

| 1.8-2.4 | 1.0-1.5 | 15-25% |

Heat Map Visualization Code

import plotly.express as px

def plot_heatmap(heat, metric_name="Return [%]", min_return=10):

"""Plot optimization heatmap with threshold filtering."""

# Pivot to matrix form

zdf = heat.pivot(index="atr_mult_sl", columns="rr_mult_tp", values=metric_name)

# Create heatmap

fig = px.imshow(

zdf.values,

x=zdf.columns,

y=zdf.index,

color_continuous_scale="Viridis",

labels=dict(x="RR Multiplier", y="ATR Multiplier", color=metric_name),

title=f"Optimization Heatmap - {metric_name}"

)

return figAvoiding Overfitting

- Test on multiple assets, not just one

- Use walk-forward analysis

- Look for robust parameter zones, not single optimal points

- Consider the diagonal pattern — many combinations work